Every November, the Federal Housing Finance Agency (FHFA) reviews current conforming loan limits and decides on adjustments to make in the following year to reflect changes in the housing market. For the previous 8 years, this adjustment has been an increase in the conforming loan limit.

Now, in anticipation of the FHFA’s official announcement regarding 2025 limits, many lenders are already offering conventional loans based on projections of next year’s increases, demonstrating a high level of confidence in the agency’s behavior.

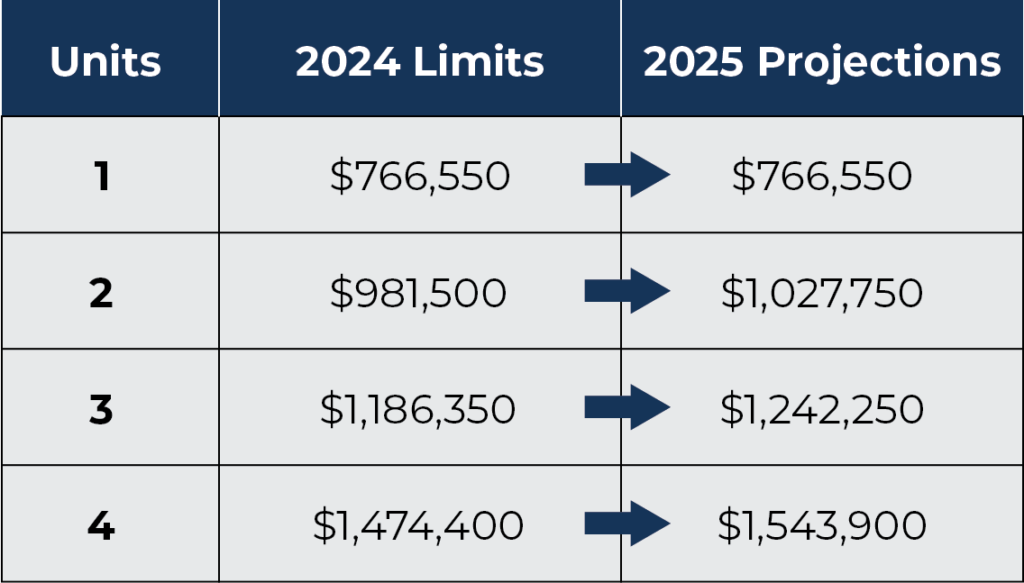

If they hold true, the projected increases would translate to a benefit for home buyers able to stay within the conforming loan limits, who will enjoy more favorable loan terms such as lower interest rates, easier qualification and smaller down payments (depending on your purchase price). Borrowers with jumbo loans under these limits will also be able to refinance for better terms. You can view the projected 2025 increases, as well as 2024’s limits in the included chart. As you can see, the limits vary based on the number of housing units you are purchasing, so investors and end-user buyers alike stand to benefit.

Will these changes affect you and your 2025 real estate plans? Don’t hesitate to contact RealSmart to find out whether or not you stand to benefit. (650) 363-2808