Hello and happy New Year to all of you! Let’s go back a generation. 25 years ago, we had the thought our computers were going to crash going from 1999 to 2000. A year later it was 9/11 and all the changes that took place regarding that event on how we saw the world and how the world saw us. Subprime mortgages were 17-19 years ago and the financial calamity that followed. Covid 19, now 5 years ago and we are still reeling from all its effects both in the public and private sector. Inflation arrived 3 years ago along with higher interest rates. Now here we are in 2025, still standing and wondering what’s next.

This leads to this year’s thoughts for real estate, and more specifically residential real estate. As I mentioned last year, I felt that inflation was going to be stickier for longer than predicted. Mortgage rates will be higher for longer too. Buyers are getting accustomed to this higher rate level. There was a shock to the system in late 2022 and 2023 with these higher rates. Buyers put the brakes on the aggressive buying, which led to lower real estate values that year.

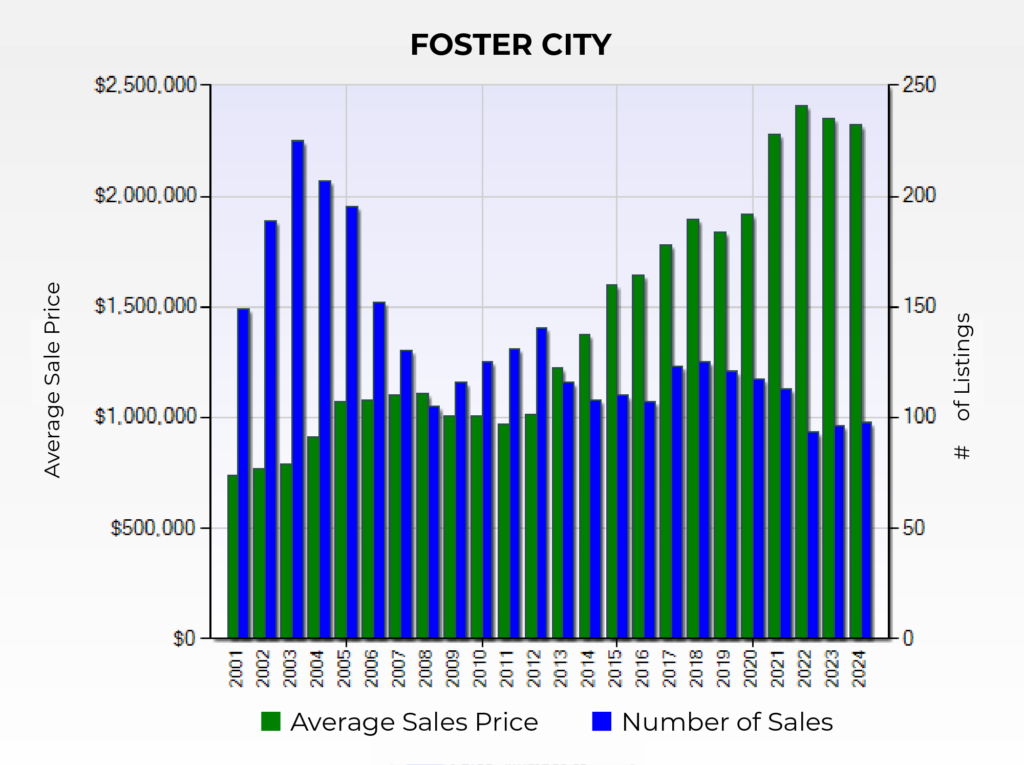

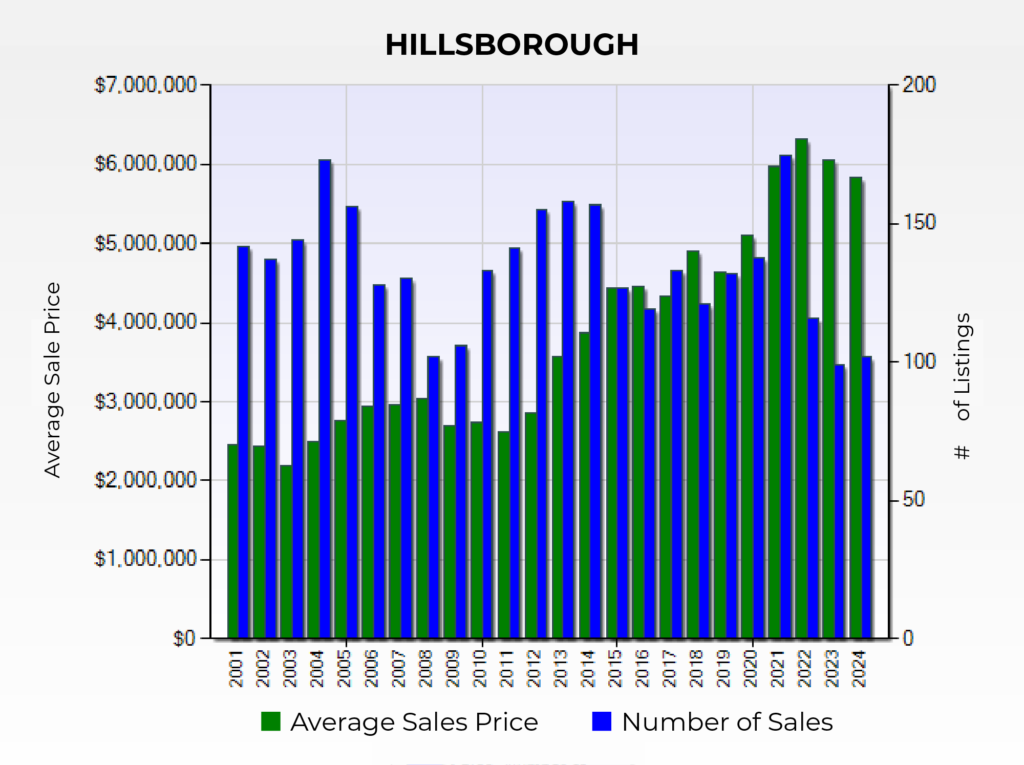

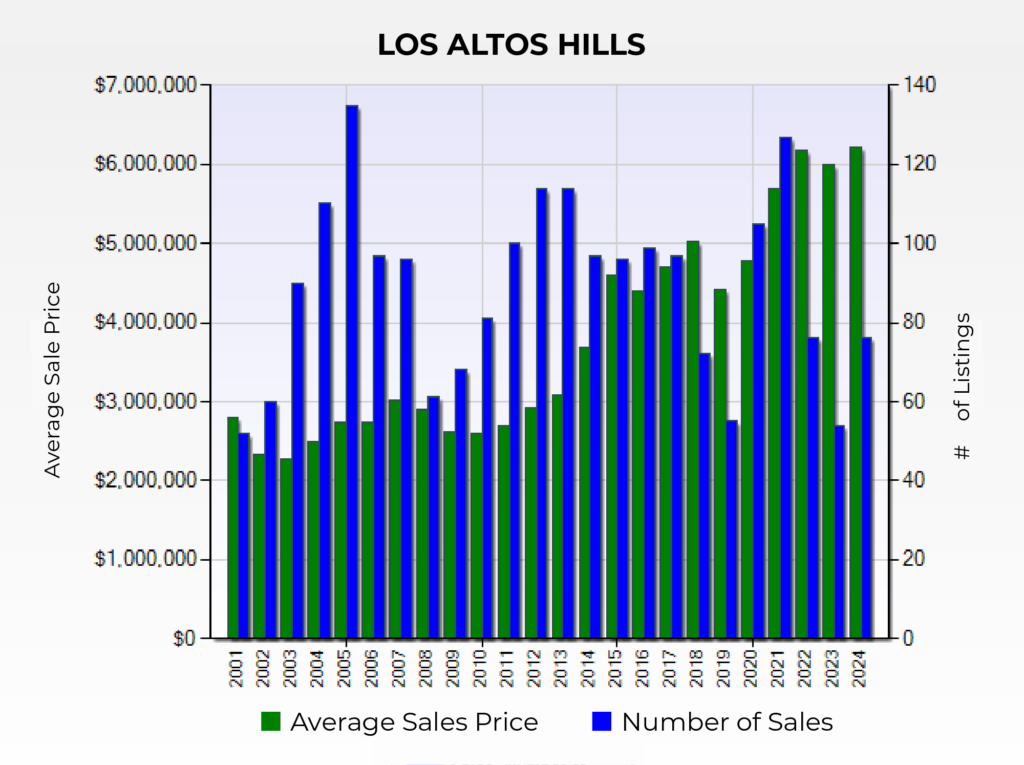

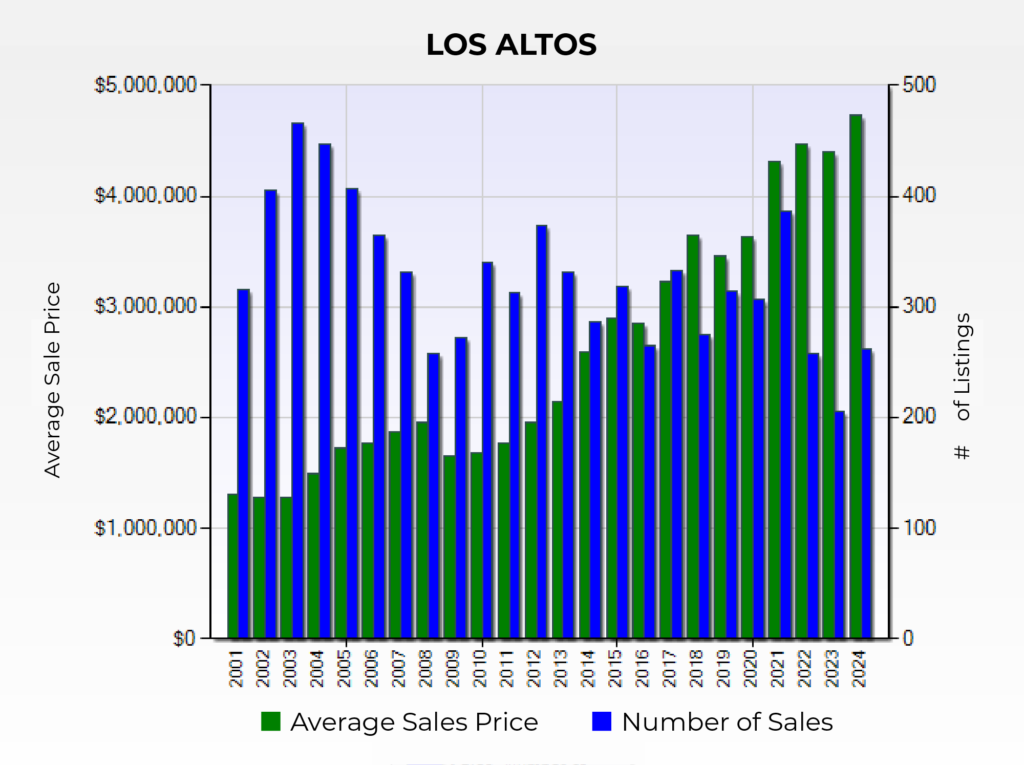

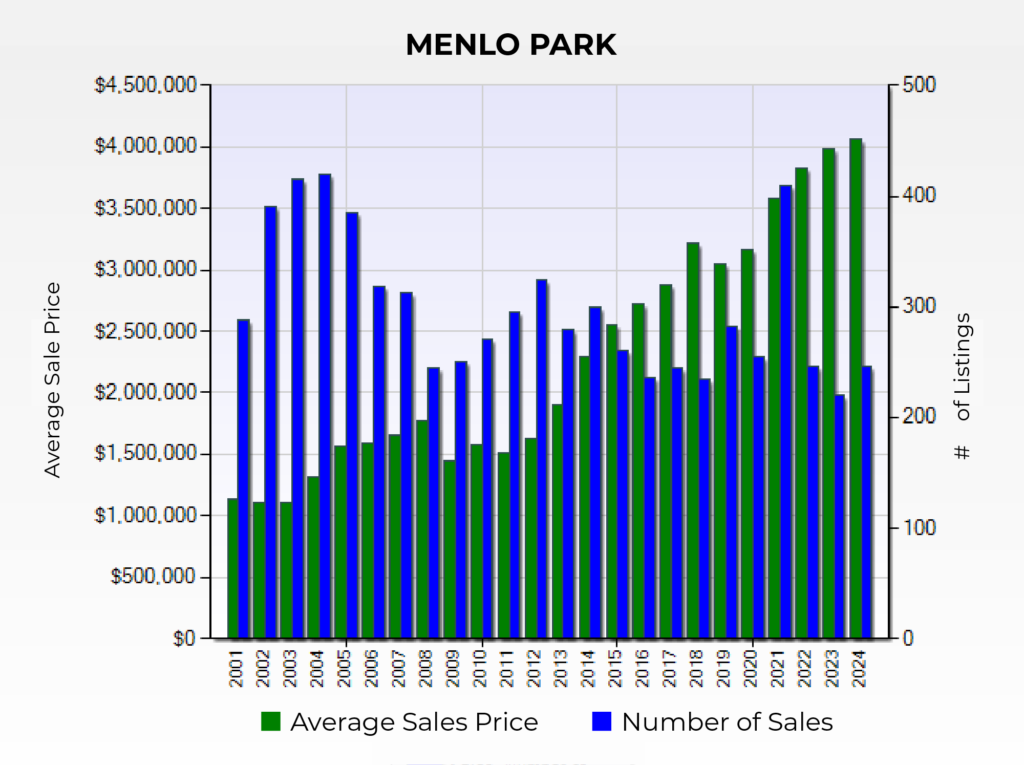

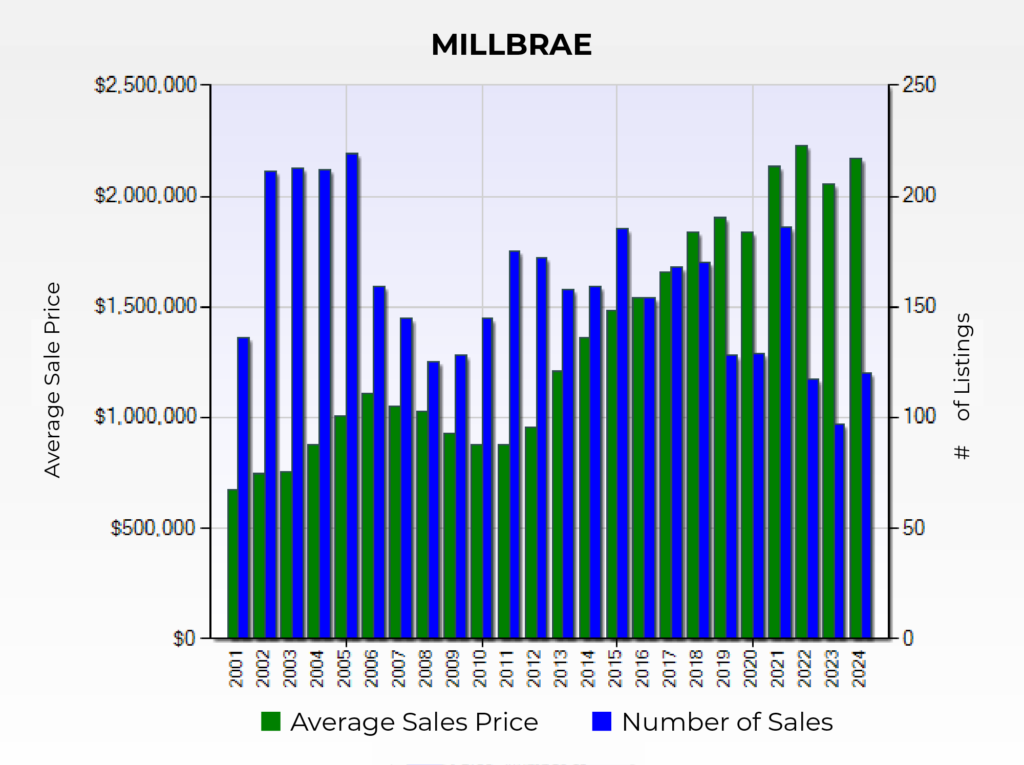

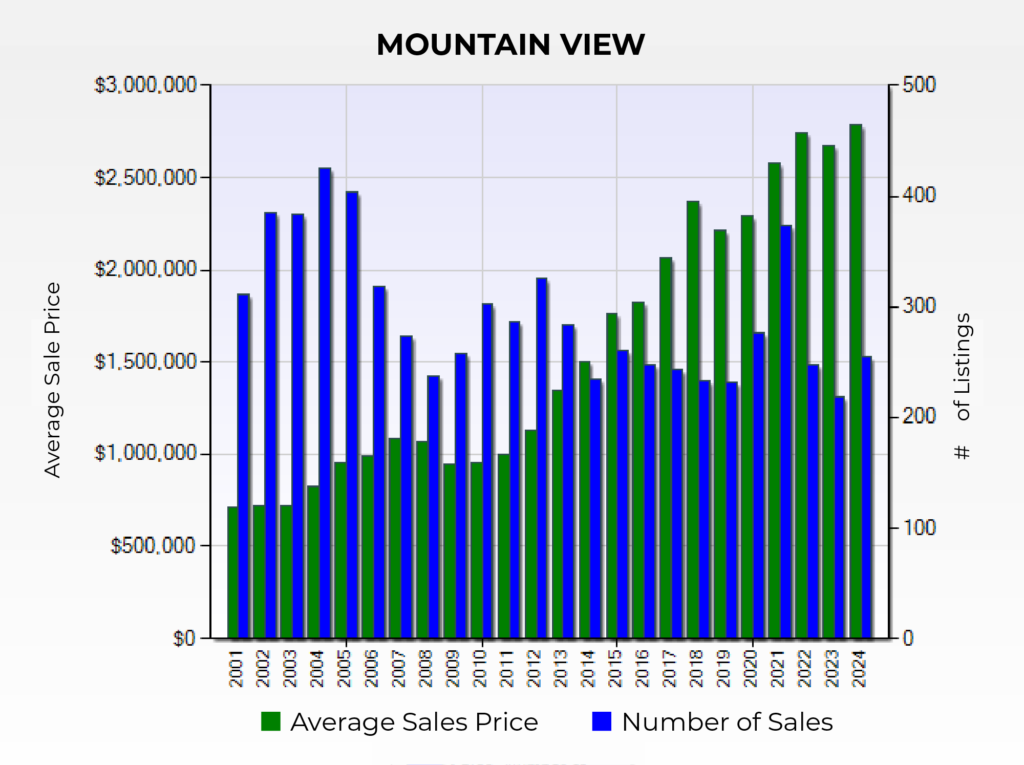

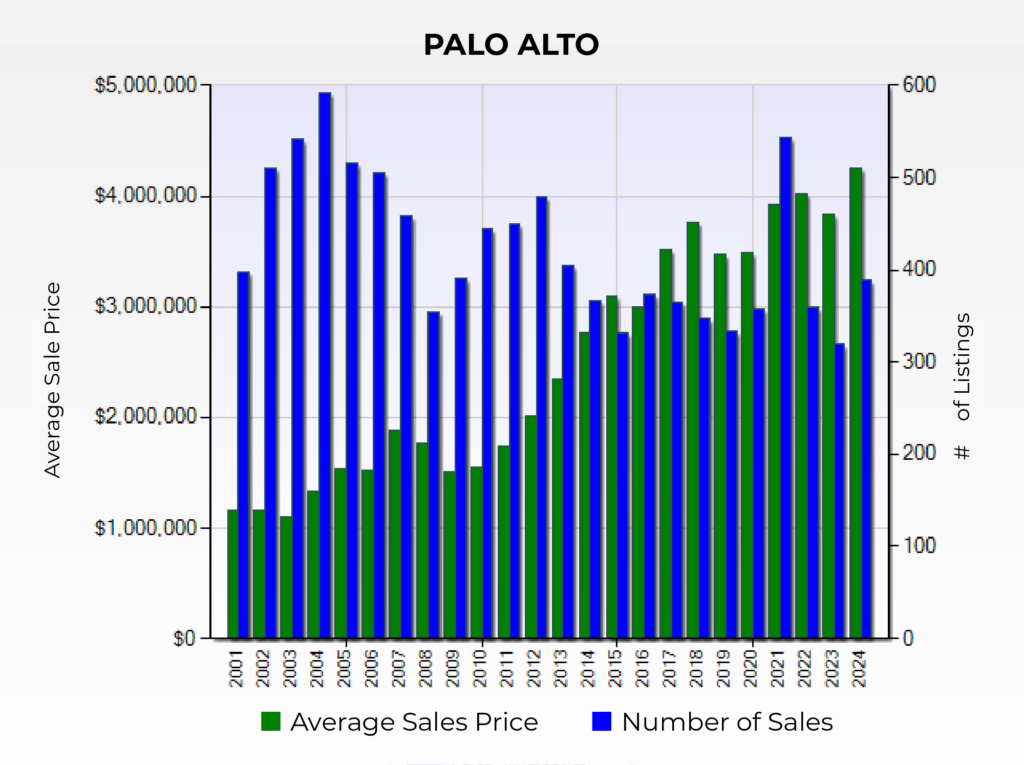

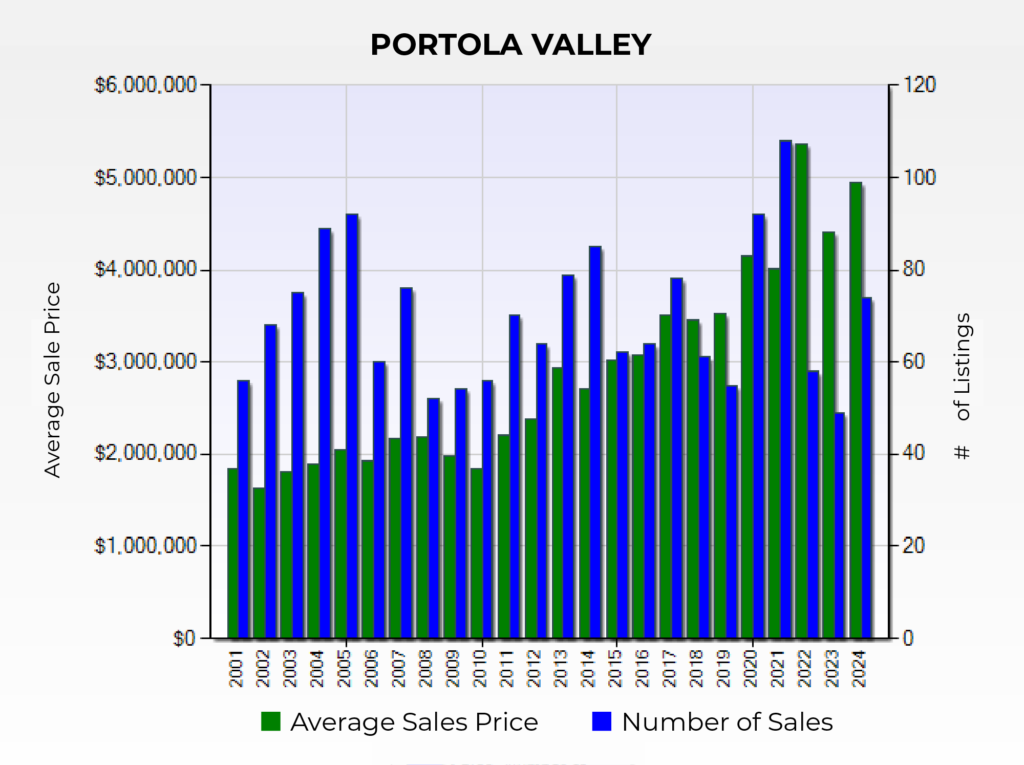

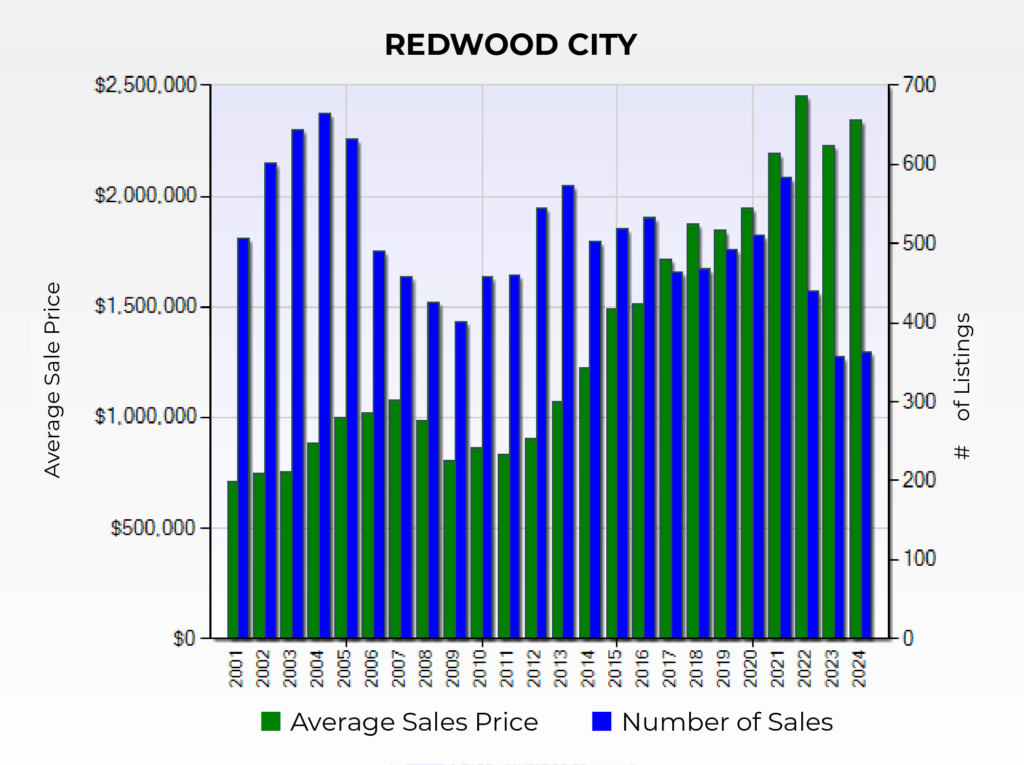

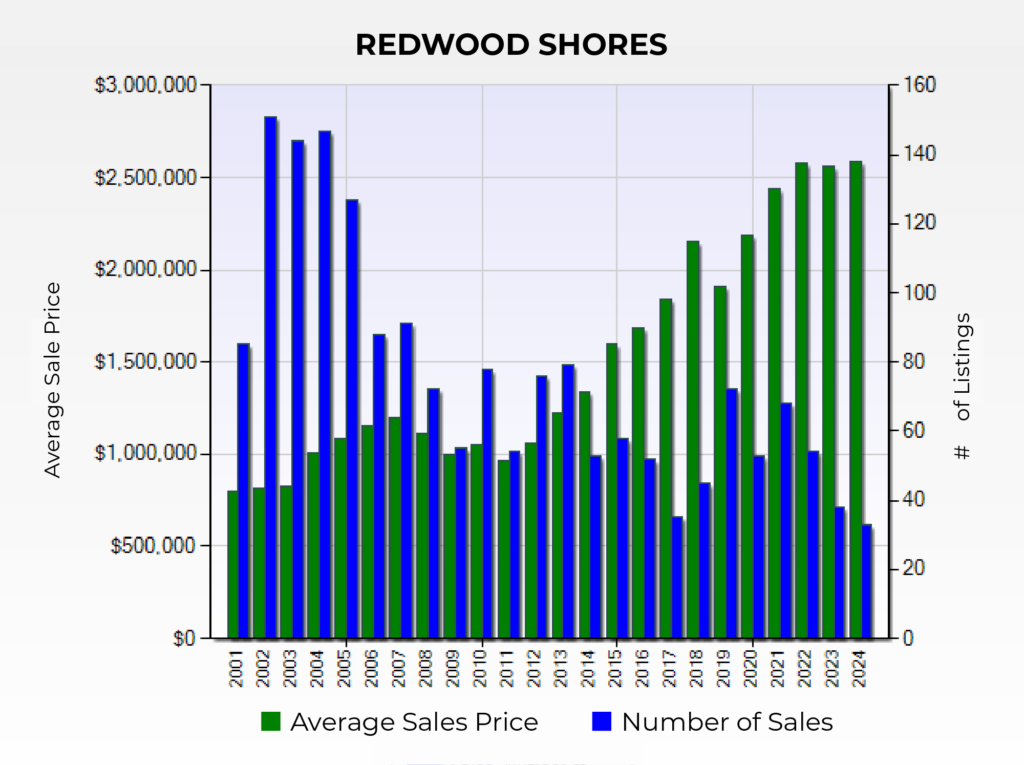

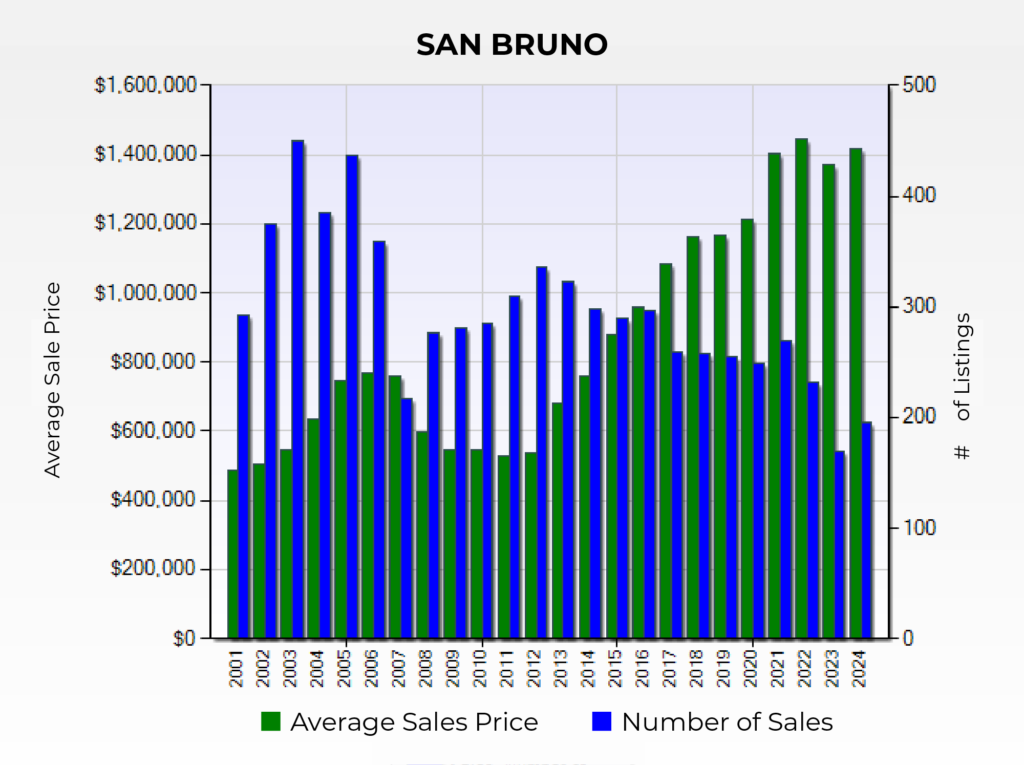

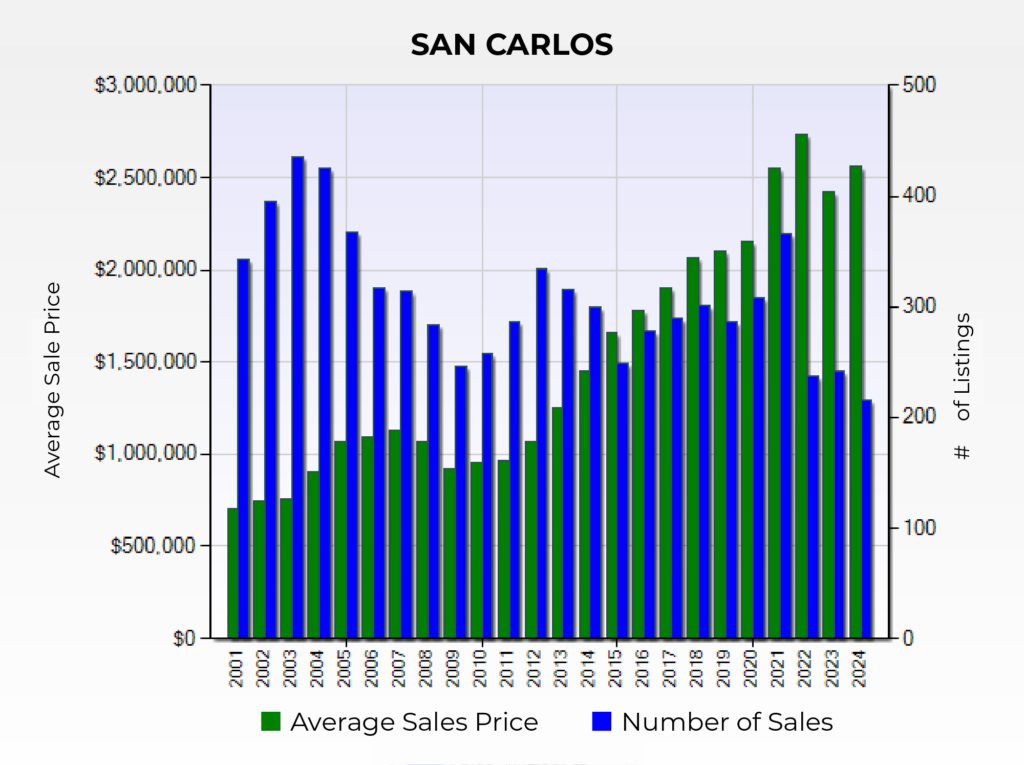

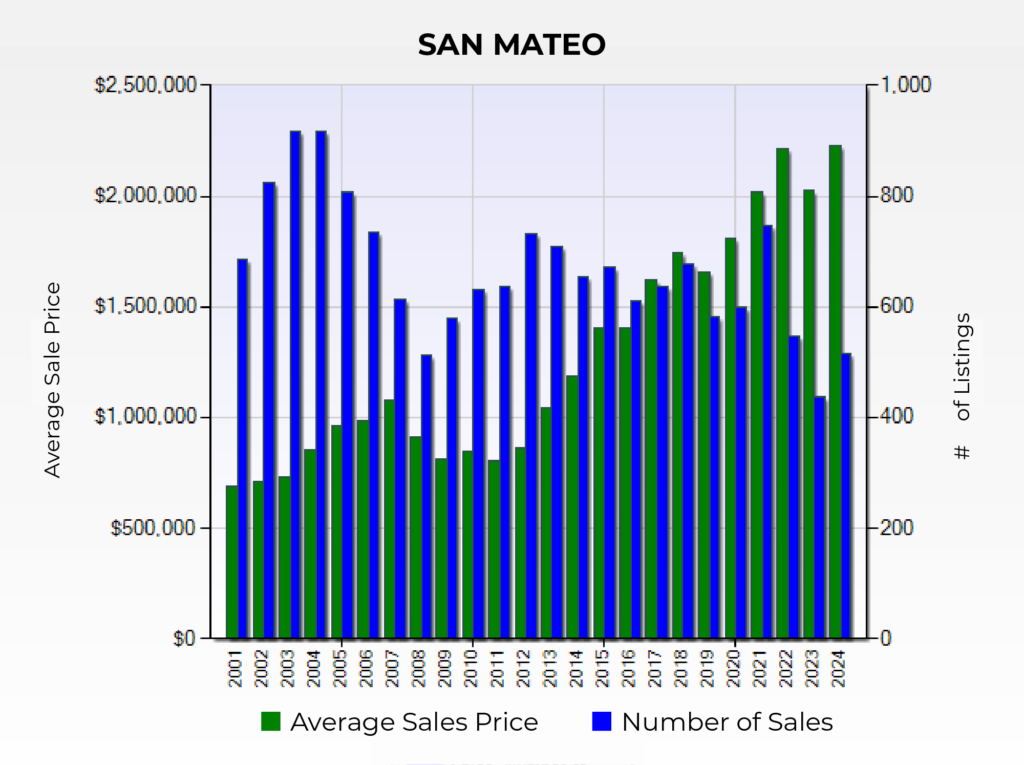

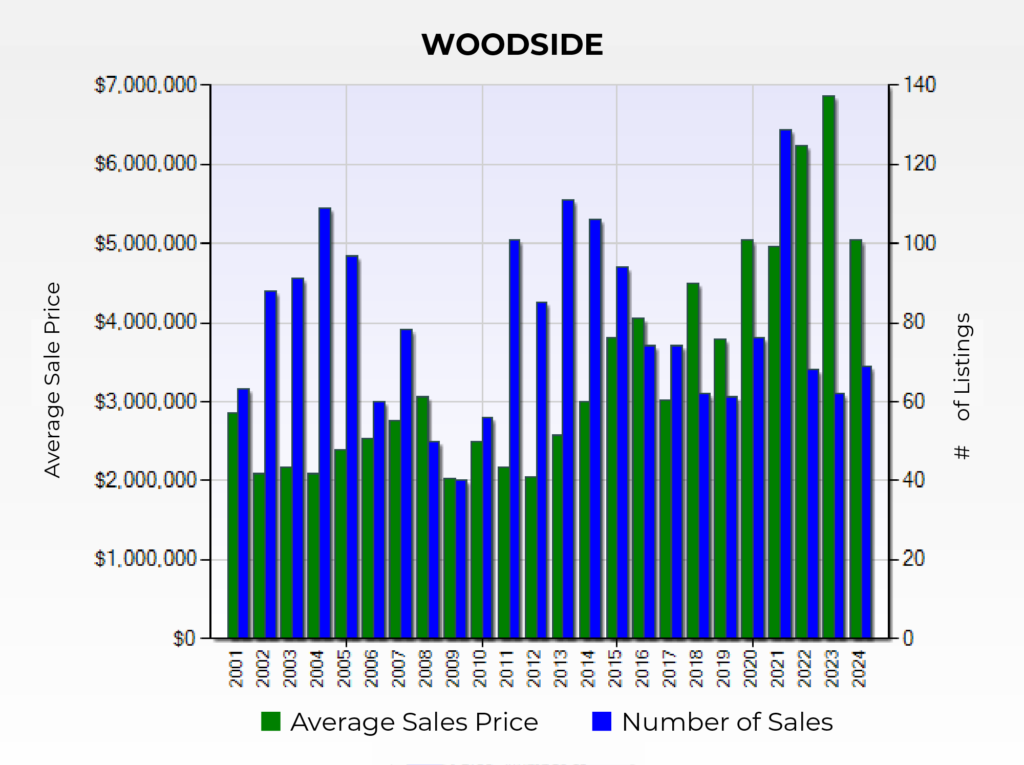

Let’s dive into the stats for 2024 with 2.5 years into the higher interest rate environment. There was reversal from the 2022 to 2023 markets. In that timeframe, 16 cities of the 19 that I track, went down in value. In 2023 to 2024, 16 cities went up in value. That’s amazing considering the cost of borrowing money.

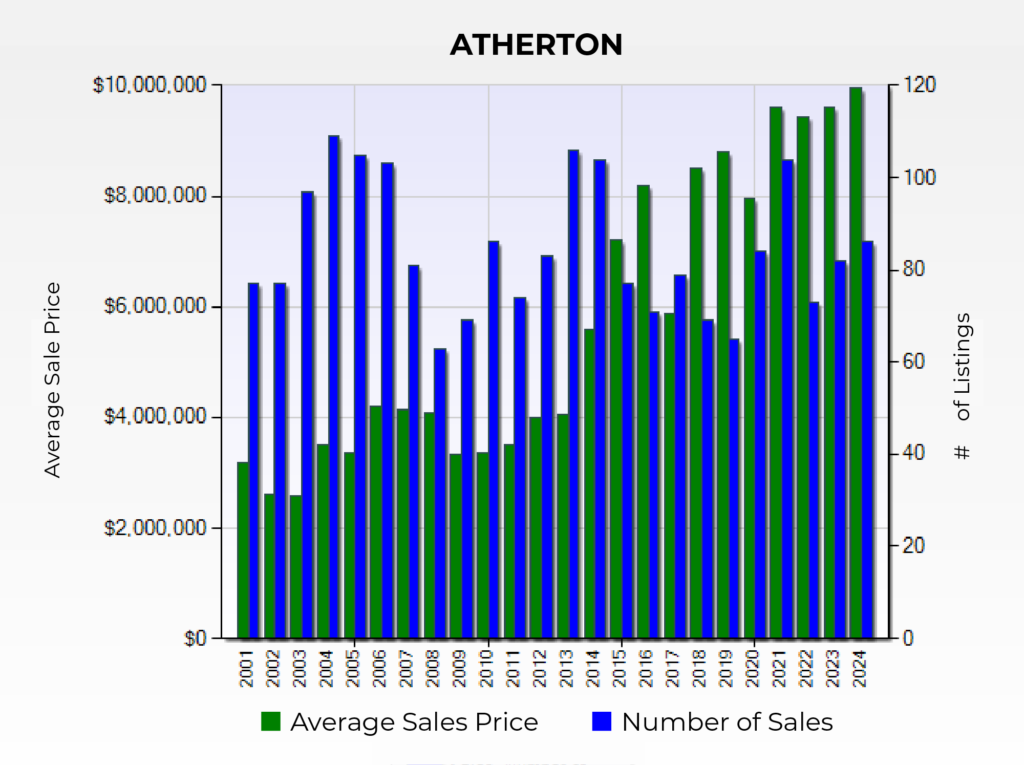

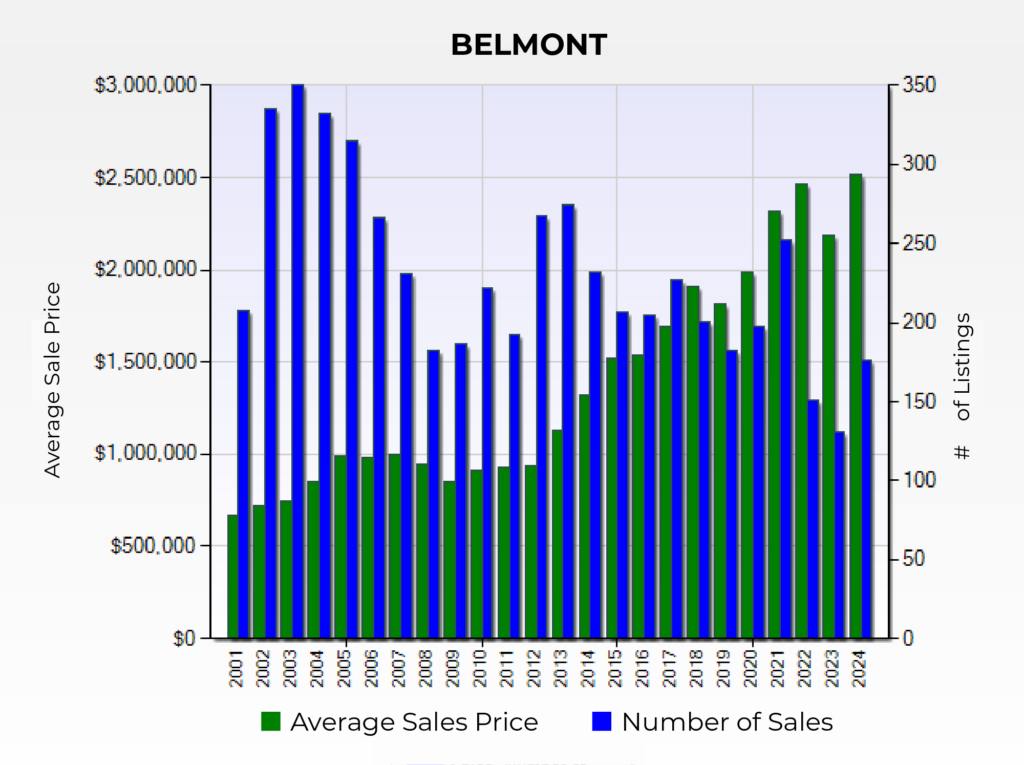

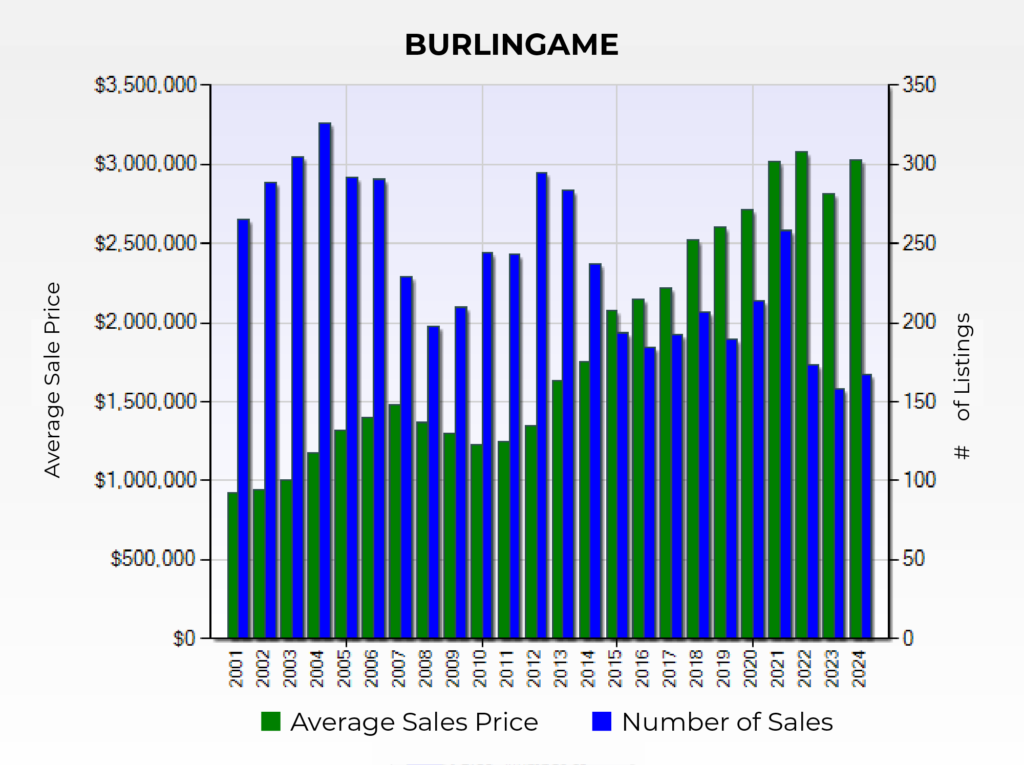

In fact, there are 9 cities that have exceeded their all-time highs in 2024, which for most was accomplished in 2022. These are San Mateo, Redwood Shores, Atherton, Belmont, Menlo Park, Los Altos Hills, Palo Alto, Los Altos and Mountain View. There are 2 cities that have consistently increased in value; Atherton and Menlo Park. This leaves 7 cities that their respective all-time highs were in 2022, then went down in 2023, but improved in 2024; South SF, San Bruno, Millbrae, Burlingame, San Carlos, Redwood City, and Portola Valley. In terms of sales, 17 of the 19 cities exceeded their respective 2023 numbers. Therefore, 2024 turned out to be a good year.

Moving forward, I believe limited inventory is still going to be a problem. There are many owners of residential real estate, that either own their homes free and clear of a mortgage or took advantage of the two opportunities to refinance to the 2.7% to 3.5% long-term mortgage rates a few years back, and have no incentive to sell, unless there is a compelling reason. This should help real estate prices to continue to increase. I also believe, as the stock market goes, we go. This equity via stock options or other stock allocations allows for down payments to be quite substantial relative to debt. It also allows for homes to be paid for in cash. This stock market run has been unprecedented. Now with AI as a big capital expenditure for corporations, this should keep the stock market rolling for the foreseeable future.

If you have any real estate questions or needs, please don’t hesitate to reach out to me.

I wish you all a healthy 2025!

Respectfully,

J.D. Anagnostou

Realtor, RealSmart Properties

jd@realsmartgroup.com

650-704-5134

DRE#00900237